A cost segregation analysis is the process of looking at and reallocating engineering-based costs relating to the construction, renovation or acquisition of a building. When properly done, this could result in additional accelerated deductions and increased cash flow.

Cost-segregation studies, which analyze the components that make up the building and assign these various components with recovery periods offering real estate and construction professionals with tax advantages

The assets are depreciated over 5,7, or 15 years, using an accelerated method, rather than the standard 27.5-year or 39-year straight-line method used for most real estate where the assets are gradually reduced over time.

Who Can Benefit from a Cost Segregation Analysis

If you are purchasing an existing building, constructing a new building, expanding or renovating a building you already own, then you can derive benefits from a cost segregation analysis or study.

Essentially, all taxpayers in the commercial real estate industry – contractors, renovators, purchasers, and investors – may benefit from a cost segregation study to determine which of their property qualifies for accelerated depreciation.

The best candidates for a study like this tend to be properties that have a depreciable cost basis of around $1 million or more. For a leasehold improvement project, this drops to around $300,000.

This means that the companies that can benefit most are large scale property developers or real estate owners of higher value properties.

Benefits of performing a cost segregation analysis include:

- Accelerate depreciation

- Increase current tax deductions

- Defer income tax

- Increase cash flow

- Provide other additional opportunities such as property tax and future retirement

Various property types that can benefit from cost segregation analysis include, but are not limited to:

- Manufacturing and industrial plants

- Health and long-term care facilities

- Financial institutions

- Automobile dealerships

- Distribution centers and warehouses

- Office buildings

- Restaurants and hotels

- Retail and convenience stores

- Shopping centers

- Apartment buildings

Tax Cuts and Jobs Act of 2017 Bring Even More Benefits

The tax reform package made two simple changes that affect property owners, contractors, investors, etc. These changes made cost segregation analysis even more valuable. Both changes related directly to bonus depreciation.

Bonus depreciation allows individuals and businesses to immediately deduct a certain percentage of their asset costs the first year they are placed in service.

The tax law made used property eligible for bonuses for the first time. It also increased the bonus percentage to 100 percent through the tax year 2022.

Prior to this law change, only new property was qualifying, and bonus depreciation was only around 50 percent.

Essentially, any assets that are removed from the “real property” bucket and placed in the “personal property” bucket may now be eligible for bonus depreciation and can be immediately expensed in the first year.

Common Questions Regarding Cost Segregation Studies and Analysis

When is the best time for a cost segregation study?

The best time to conduct a cost segregation analysis is the year that the property is placed in service by the current taxpayer. It is most beneficial to maximize depreciation deductions from the first year, whether the property is new construction or a new acquisition.

An under-utilized practice known as “tax engineering” can also be employed by companies and architects at the blueprint stage to incorporate building designs that will enhance tax savings for years to come.

Getting ready to break ground on a new building or still in the design phase? Contact Tri-Merit for more information on tax engineering and to learn how much you can save!

How much does a cost segregation study cost?

The cost of a cost segregation analysis can vary greatly, depending on the size, type, and complexity of the property, as well as the quality of the provider and their work product. This varying cost is because not all cost segregation analysis studies are the same.

The fee for a cost segregation analysis should be based on time and materials, or on a fixed fee basis, but never on a contingency basis (for example, a percentage of the savings made).

This is because a contingency fee like this gives the cost segregation consultant an incentive to be overly aggressive and use inappropriate estimating techniques in order to maximize their own profits. Any reputable cost segregation provider should work on a fixed fee basis, or a cost based on time and materials.

How much should I expect to save with cost segregation analysis?

It isn’t unheard of a cost segregation study to generate hundreds of thousands or even millions of dollars in net present value savings.

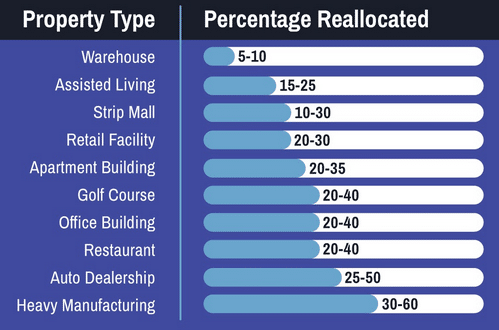

The average study allocates or reallocates anywhere from 20 to 40% of the depreciable cost basis.

Below is a chart that has the typical percentage of a property that can be reallocated from real property into shorter-life personal property asset classes based on the property type.

Will cost segregation put me at risk of an IRS audit?

You are at no greater risk with new assets (newly constructed or a new acquisition) than you are by filing a regular income tax return. A look-back study will not require filing an amended return, but will require the taxpayer to file a change of accounting method, which will then be reviewed by the IRS office.

These studies might be sent to IRS departments that specialize in cost segregation, where they then might be selected for an audit.

From this, it is possible to assume that a look-back study may be a little more likely to be audited than a new property that has used a cost segregation study. This is one of the reasons it is so important to work with a qualified and experienced consultant. Click here to learn about Audit Defense with Tri-Merit.

The preparation of a cost segregation study requires knowledge of both the construction process and tax law involving property classifications for depreciation purposes.

Choosing someone based on their credentials and level of expertise can have a huge impact on the overall accuracy and quality of a study.

This is why so many CPAs and CFOs trust Tri-Merit to deliver a quality cost segregation analysis that will hold up against audits.

By coding standard IRS requirements and conducting site inspections, you are guaranteed a comprehensive work paper file and supporting documentation with every study.