Reliable Cost Segregation Analysis

by Specialty Tax Professionals

Make your real estate investments work for you sooner rather than later.

Cost segregation is a commonly used tax planning strategy and a smart way to increase cash flow by accelerating the depreciation of commercial building costs.Many businesses overlook cost segregation, but it can save a company thousands of dollars a year.

A cost segregation (“cost seg”) study is an in-depth engineering analysis of the depreciating value of long-term fixed assets, like newly constructed buildings, property acquisitions, and renovations. From this data, companies can accelerate tax deductions and improve their cash flow.

A quality engineering-based cost segregation study from Tri-Merit allows building owners to write off their building (new and existing) in the shortest amount of time permissible under current tax laws. The favorable depreciation rules contained in the Tax Cuts & Jobs Act (TCJA) create incentives for the greater use of cost segregation studies.

It’s important to work with a partner that has the right experience and can deliver a quality study that meets all IRS guidelines—a partner like Tri-Merit.

Ready to learn more? We’re here for you.

Why invest in a cost segregation study?

A cost segregation analysis can reduce a company’s taxable income for several years and, consequently, improve their cash flow. The main objective is to move components of a property from “long tax life categories” to “short tax life categories.”

If these components belong to short tax life categories, they acquire a higher depreciation rate during the early years, decreasing the company’s taxable income. The business, therefore, has larger financial resources.

Take note that cost seg services don’t create new deductions. Instead, cost segregation increases tax deductions during the early years of the business. By front-loading deductions today, businesses have more money to invest in expansion, process improvement, and research and development tomorrow. Furthermore, companies are better-placed to take advantage of the time value of money.

How does a quality cost segregation study reduce tax liability?

A building is commonly depreciated over the 39 or 27.5-year life assigned to real property. Cost segregation studies identify and reclassify components such as electrical, plumbing, mechanical and finishes into 5, 7, and 15-year property. This reduces the building owners tax liability in the near-term.

Tri-Merit’s cost segregations services evaluate you or your clients’ assets thoroughly and assess everything that can be factored into the study, including newly purchased buildings, improvements on buildings, equipment, and land. Our studies also take into account the electrical or plumbing costs related to operating machinery and equipment.

The final written cost seg report will provide the information needed to calculate your or your client’s accelerated depreciation deductions. The study can also serve as supporting documentation during stringent IRS audits.

Through effective cost segregation analysis, we decrease tax liabilities to a minimum. The benefitting parties will enjoy reduced estimated quarterly tax payments and maximize both property and transfer tax savings.

A quality cost segregation study is a tremendous tax planning technique for businesses who own their own building or who have recently acquired a new property. The tax savings generated by depreciating more assets exceed the cost of conducting the study.

With Tri-Merit, you will avoid:

Unnecessarily High Fees

Losing Great Clients

Lack of Responsiveness

Dissatisfied Clients

Poor Audit Results

Inefficient Processes

You deserve an R&D Tax Credit & Cost Segregation Partner You Trust.

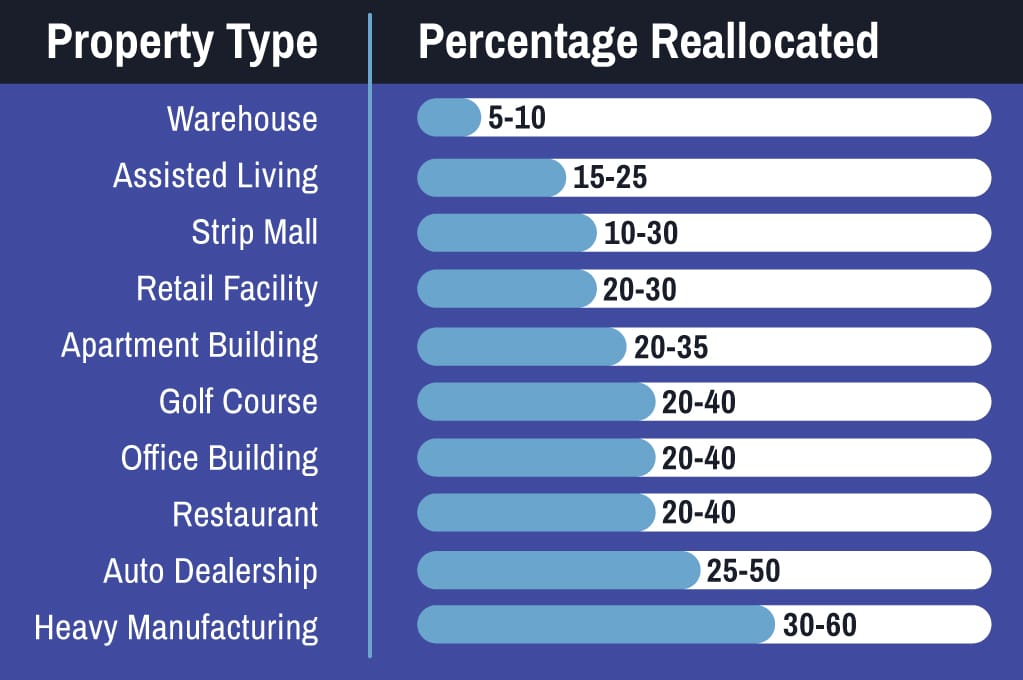

What types of commercial properties qualify for a cost segregation study?

Our cost seg studies evaluate various types of assets for businesses in diverse industries. Take note that cost seg studies differ from industry to industry.

If you are purchasing an existing building, constructing a new one, expanding, renovating a building you already own, or constructing leasehold improvements, then you can reap benefits from a cost segregation study.

Even if you purchased, constructed, or expanded the building years ago, a cost segregation study can still get you depreciation deductions that you failed to claim without having to amend previous years’ returns

- Manufacturing and industrial plants

- Health and long-term care facilities

- Financial institutions

- Automobile dealerships

- Distribution centers and warehouses

- Office buildings

- Restaurants and hotels

- Retail and convenience stores

- Shopping centers

- Apartment buildings

New construction

Leasehold improvements

Buildings valued above $500,000 (excluding land)

Real property stepped up through estate

Purchase of existing property, renovations or expansions

Existing property placed in service after 1987

When quality counts, Tri-Merit cost segregation studies deliver.

According to the IRS, the preparation of a cost segregation study requires knowledge of both the construction process and the tax law involving property classifications for depreciation purposes.

Choosing a preparer based on their credentials and level of expertise can have a bearing on the overall accuracy and quality of a study. This is why so many CPAs and CFOs trust Tri-Merit to deliver a quality cost segregation study that will hold up against the most stringent IRS audit.

By coding standard IRS requirements and conducting site inspections, you are guaranteed a comprehensive work paper file and supporting documentation with every study. Documentation often includes civil/site work, structural, architectural, plumbing, electrical and HVA. When quality counts, Tri-Merit delivers.

Businesses from different industries, along with CPA firms, trust Tri-Merit’s cost segregation services because we:

Boast Advanced Technical Expertise

Tri-Merit has a detailed understanding of the latest IRS rules and tax regulations regarding property depreciation. We review your assets extensively for maximum tax deductions. Tri-Merit has the right combination of accounting, appraisal, and engineering skills so we can compile an ironclad cost seg report that can hold up to an IRS audit.

Make Everything Easier

Working with Tri-Merit is a breeze. If you’re a CPA firm that needs a third-party firm to conduct a cost segregation analysis, we will align our processes with yours. If you’re a business who wants to conduct a cost seg for your assets, we customize our approach to streamline collaborative efforts.

Reliable and Transparent

Our team provides regular updates, so you are aware of the progress of the study. Expect the cost seg report to be completed and delivered by the deadline. With more than 35 years of experience, we have provided thousands of successful studies across the country.

Risk-Free

You only pay Tri-Merit a fee if you decide to move forward with a study. Moreover, Tri-Merit assumes the risk; we’ll defend your cost seg analysis should an audit occur.