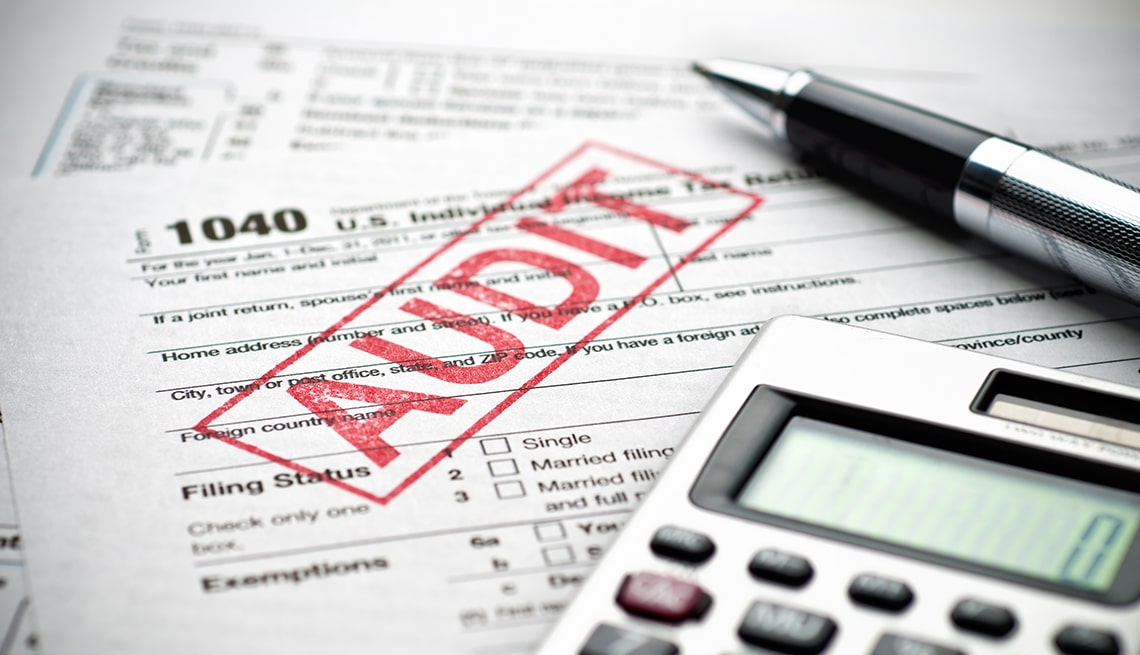

While audits may be inevitable, they can be managed effectively with the right approach. You can confidently prepare for any audit with careful planning and a knowledgeable team. Tri-Merit provides comprehensive tax audit defense with every study, ensuring you have support throughout the process. Our team’s deep understanding of engineering-based tax credits and technical expertise aims to maximize your return without resorting to inflated claims for quick wins.

Audit Defense by Tri-Merit

When facing an IRS audit, it’s crucial to accurately defend your tax returns. Audits involve a thorough review of income, deductions, and credits to ensure correctness, particularly for engineering firms where finances are closely scrutinized. Misreporting can lead to additional taxes, interest, and penalties, but not all audits indicate a mistake; even clean records may attract attention. The key to minimizing audit risk is maintaining precise tax reporting, especially for firms involved in research and development. If selected for an audit, having proper documentation is essential. Tri-Merit ensures your tax records are robust enough to withstand strict IRS scrutiny, leveraging our expertise in engineering-based tax credits to provide peace of mind.

The Odds of Getting an IRS Audit

While companies dread the possibility of an audit, the chances of undergoing one are low. In fact, in 2023, the IRS audited less than 1% of the 196 million tax returns it received. As such, the odds of being selected for an IRS audit are less than 1 in 200.

It doesn’t mean, however, that taxpayers should be complacent. Certain characteristics make a business more likely to be audited than the rest. For instance, failing to report a part of its income may catch the attention of the IRS, and so does claiming too many charitable donations. Reporting too many losses on Schedule C (if you or your client is self-employed) and deducting too many business expenses also raises the chances of triggering an audit.

So, to maintain clean records with the IRS, you need 1) accurate calculations for tax claims and deductions and 2) an ironclad defense should an audit occur.

Tri-Merit provides these with every service.