Viral Marketing with Duke Alexander Moore

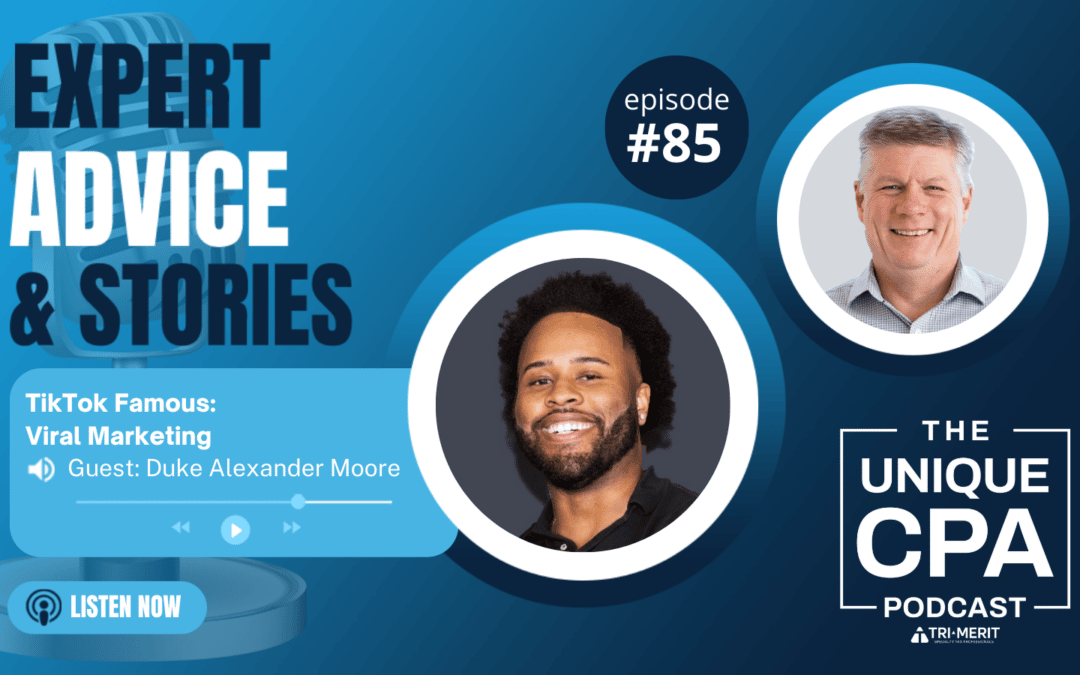

On Episode 85 of The Unique CPA, Randy talks to Duke Alexander Moore, best known as the popular DukeLovesTaxes on TikTok, where he has 3.4 million followers and counting. Duke’s passion for the business of taxes is evident as he discusses the growth of his brand and social media presence. He shares some handy tips for dipping your toes into this arena of free marketing.

Today, our guest is Duke Alexander Moore. Duke is a certified tax coach and an enrolled agent. He is the owner of Duke Tax, which he started in 2018. Duke Tax is a professional firm that works with creators, artists and entrepreneurs. I think you’re gonna have a fun time listening to Duke today, because he has extreme passion for a couple of topics that I do as well, which is tax and education. I’m gonna get his tagline wrong—I’ll ask him after I mess it up here—but he talks about making tax easy to understand. And because of his passion, and his goal of educating, he has become, I guess, TikTok famous. He’s got 3.4 million TikTok followers on which it goes under the—what do you call it, handle?

Yeah.

—Handle of DukeLovesTaxes. I think that’s his handle on all social media—also Instagram, 137,000 followers there. He’s been featured on Good Morning America, CNN, CNBC. Duke, welcome to The Unique CPA.

Man, what an intro! I think I need to like, I need a copy of that, you know? And when I’m on the big stage one day I did like that, you know, like, “You ready to rumble?” but we’re just playing Randy’s points right there. That was amazing. Thank you for that.

No problem! You were already on the big stage. I apparently I met you a couple weeks ago at QuickBooks Connect which was great and awesome. The Connect was great and meeting you was great.

Yeah, likewise!

But I came back to the office I was telling my marketing department about this guy I met, Duke, he’s got this DukeLovesTaxes, and they went crazy! They knew you! They all knew you! I didn’t realize this was a thing.

It’s exciting.

It’s pretty awesome. I mean, and it’s for doing good, you’re out educating people on a subject that’s pretty hard to understand sometimes.

Yeah, it’s a great feeling. So that’s good to know.

Yeah! And I’m going to ask you about that. But before we do that—because you have this passion, and you can tell in the videos your passion comes through for taxes—where did this come from? How did you start we’re just gonna jump in with what’s your what’s your tax origin story?

Yeah, let’s get straight to it. So I was always, like, I would say like a nerd or math, like I was always a numbers person. Growing up I remember my mom bought me like this multiplication table. I don’t know, some game, I was like “Oh, this is so cool.” You know, I kind of like numbers, so that was pretty cool.

So how I got involved in taxes: I know I always wanted to be like dealing with numbers, whether it be engineering, or something that had to deal with math. But how I got into the tax world was actually when I was around 15 years old, I did like modeling here in Dallas, Texas. I worked with agencies, so we did—I was really big with JC Penney, you walk around and it’s like “Oh my god, there’s Duke!” I did Neiman Marcus, Frito Lay, you know, I was on the back of game boards. But like at that time, little did I know, I was 1099. They don’t tell you that. They don’t tell you until February, when we get that 1099 in the mail: Hey, yeah, I forgot to tell you, but yeah all this is subject to FICA taxes, income, federal taxes, you name it. And we’re in Texas, no state taxes. But so I was like, “What is this?” So my parents hadn’t ever seen it before either. They were on W-2s their entire life. So you know they’re like, “Alright look, we’re gonna drive you down here at H&R Block. We’re gonna figure this out together.”

So then they kind of taught me about the entrepreneur life, small business, writeoffs. Then I filed my taxes there, and I ended up with a tax bill of about $1,500 my first time filing taxes, and I was like, “What? I thought I was supposed to get a refund.” So that was like a surprise to me. But that’s where I really kind of got interested about taxes. I’m like, “Okay, this is really, really cool.”

So I went to school—you know, I really just wanted to do taxes, like I don’t know, I just loved it. I went to school to become a CPA, realized you don’t need a CPA to do taxes. So I dropped out of college, still in debt, so we’re paying that back, then I became an EA instead—I found out about an EA while I was in college, I’m like, “Well this is all I want to do!”

Yeah! Right!

You know, they had me taking Sign Language, and Spanish, and you know, like this, I don’t want to do this! Economics, and macro, micro, like okay! So yeah, I dropped out, started my business, always been passionate about educating people and making it really easy to understand. And where the passion really comes from itself is actually people saying thank you, or you helped me, or this is how you helped me, you know, our family’s able to eat now—I didn’t know about this credit. You know, there’s things out there and it just frustrates me so much because there’s things out there that can help so many people, and we just lack the education.

Why do we lack the education? Maybe people just aren’t, you know, motivated to learn about it, or maybe it’s the education that’s out there, because it’s kind of boring. So I took that problem like “Okay, how can we get this education, because it’s super important, especially during COVID times, we got a credits, we got a child tax credit you could’ve opted out of, we got the PPP and the ERC and I mean, there’s so much stuff out there, people just don’t know about. So my whole goal was just like, get this information out there, but understand that there’s a problem that taxes is boring, so how do we you know, like, get rid of that?

So my whole goal was just, I really had a passion to you know, make it entertaining, educating, and, you know, make sure that information is still getting out there.

That’s awesome. So 2018, so it’s only four years now or whatever, four plus years that you started your business, doing tax and accounting. And did you, were you doing the social media on taxes before that? Was that after that? When did this get born?

Yeah, so I was like trading videos like even like in like, in like middle school I was like a video creator. But how did social media—I would say it started in 2019. Like I heard about TikTok, so I’m like, I’m gonna see what this thing is all about, you know, people just be dancing, or like, you know, I’m gonna check it out. But this video came across about taxes. It was kind of talking about taxes. He had a million views. I’m like, “First of all, you’re wrong. Like, the video was wrong.” Second of all, I’m like, “I could do this! Like I could do this! So it’s really, like, inspiring. So I jumped into it in ‘19, things picked up in ‘20, really took off in you know, 2021, duringthat COVID era. So, you know, that’s how it kind of took off, and it’s been great with the benefits on the other end. So it’s like, for everything you put in, you get out an equal return. So it’s been paying a great return as well.

Yeah, a couple of things you said that I want to go back to—one, you saw a video and it was wrong.

Yeah.

There’s a lot of misinformation on taxes on social media in general. And I think TikTok’s a big area. Are you seeing that as well?

Oh, yeah. That’s what helps me go viral. Like they’re like, “Oh, tag Duke! Tag the tax guy. Let’s see what he really has to say,” in the comments. It’s like, “We won’t believe it till he says it!”

That’s awesome.

“If Duke isn’t saying it, it’s not true.” That’s what I they say.

That’s just unbelievable! So have you—and I think I saw one where you’ve shown someone else’s video, and then you’ve said, “Okay, that’s wrong. Here’s the correct thing.” Is that something you do often?

Yeah, so I started more recently, and it’s all about, it’s really about the approach as well. Because it’ll be funny, I’ll be scrolling, and I’ll be like, “Oh, this is wrong. Like it’s so wrong.” And I look on the page and it says, “Follow back.” I’m like, “Oh my God, they’re a supporter.” So I’m like, “Oh, okay.” So I always had to start the videos out, like, “Hey, no hate to this person. Like, I love your videos. But it’s just the right way to do it.” So I had to develop the approach.

Right.

It’s a wake up call that people follow you, they look up to you, because there’s certain people that I’ve looked up to, and they’ve said something to me, and it just destroys you. It’ll really, like, bring you down if someone you look up to truly like, says something. Maybe they don’t even know that you look up to the person, I have no idea who looks up to me, maybe this person and just hearing that it’s just like, it will destroy you.

Right.

So I never want to create that feeling that someone has given to me. So I’m like, prefacing like “Hey, you know, like, you know, this is great, I love your videos. But you know, my goal in this app is just to provide accurate information.” And then I kind of go into it, but I make sure I say what I have to say first.

And so from an education standpoint for yourself then, how are you staying on top of everything? Because you’re putting out timely videos on things that are happening.

Yep.

Do you have, you know, how do you pick and choose what to put out there? And how do you stay on top of everything that’s happening, tax-wise?

Yeah. So I literally—I have a, it’s almost an automation that I have. But so if you Google, like if you want to Google taxes—Google taxes, and then there’s a search, there’s a tool in Google that allows you to view only results that has been posted within the past 24 hours.

Okay.

That’s it. So I’ll have I have like 15 tabs, they’re all Google searches that happened in the past 24 hours—one’s taxes, one was the Inflation Reduction Act, one’s stimulus, one’s the child tax credit, one’s tax policy, one’s Accounting Today. Like, it’s just a bunch of those Twitter, Reddit, and I believe it’s super important to gain a following, to be, you know, have it’s, you know, that you’re putting out news and information. Not only are you putting on education, but you’re also putting out new and relevant things because taxes are always, forever, forever changing.

So that’s the whole goal. The only—there’s a small caveat with that. When you want to be first, sometimes you’re wrong,

Right.

Sometimes your information, it’s inaccurate when you’re growing too fast. So that’s something that I have to learn like, Okay, don’t be too fast, do your due diligence, work it out because there’s been—I’ve learned from my mistakes. And fortunately, we don’t have those mistakes anymore. But it’s not about being first, it’s about, you know, getting it out there, but make sure it’s out there very accurately. And I have made those mistakes, or I have not set it clear enough where it can be taken the wrong way. When I’m like, “Okay, I did want to do this. I said this,” but like, “Ah, I see why it was taken that way.”

Yes.

“Let’s make a follow up video.”

Yeah. And we experienced that I’m sure you did, as well with the CARES Act, and just everything that was coming out so fast back in early 2020. A big thing that we got into was the Employee Retention Credit. And I think, you know, we didn’t really jump into that until the Consolidated Appropriation Act that made the major changes to it, but I think I had a webinar out in February of ‘21. And I look back at that, and I think I did pretty well, but there was a few things that we needed more interpretation on. And I’m like, “Okay, if I would go back, there’s a couple of ways I would say this different.”

And then honestly, it was, part of it was just my interpretation on a couple of things was like, “Okay, this is wrong, this is how I interpreted it.” I went back and future webinars and said, “Okay, I know I said this back in February, but now this is the case.” So have you ever done any correction videos like that?

Oh yeah, yeah, I go on there and I’m like, “I am completely sorry. Like, I can see how you guys took that away.” And then of course, you just have the people in the comment section, “Those people are dumb. We didn’t take it that way.” That is too funny. You just have your diehard fans. But it’s like, you know, I’m always, I’m literally obsessed with improvement—whether it be self improvement, whether it be improving the processes of our business, I’m literally obsessed with it. So all feedback is good feedback to me, whether it’s negative. And I understand it, and I believe that’s the only reason I’m here today, because I’ve taken feedback. Man, I just, you know, straight up and down listen to it, and just make sure I deliver it correctly going forward.

That’s awesome. That’s a great skill. I’m not sure I’m the best at taking feedback.

I love it.

I do, but it’s like sometimes I just don’t want to hear it. And but I really know I need to. But I’m old. See, I’m done learning. You’re young, you’re still learning all this stuff, and you can use it a lot longer.

Hey, so a couple things, then. Let’s go back to now, you know, you’re doing this, you know, ‘19 you started, ‘20 it ramped up. Oh, and by the way, I was telling my marketing department that you and I were talking and they said, “Let him know that his videos helped me get through COVID.” And so, I think that’s awesome.

I love that! Thank you, thank you.

Yeah! Because you’re not just educating, you’re entertaining too.

I mean right, that’s the goal.

Which is huge, the entertainment factor is huge. And so yeah, I didn’t realize what a big deal.

So now let’s go back to this in general: So you’re doing this and you love doing it, obviously it shows through when you’re doing it. But there also has to be other than just this education part of it—which I’m a big, you and I are in the same wavelength with a lot. I’m always saying, share your knowledge. I want to share my knowledge, whatever I have, I want to share it. I always figure that’s going to come back to me to our company, if I’m out educating people. Do you get like inbound leads, direct business then, just from the TikTok channel?

Yeah. So yeah, so TikTok, has like, you know, turned us in almost like a million dollar a year business just like that. And then some brand deals and then TikTok leads, with now our business just, it’s just extremely grown. And so like, for example, I’ll post a video. Today I went, I went live today, like maybe for about 30 minutes. During those 30 minutes—so I believe if you have like a TikTok following or some type of social media following, you got to have something—you’ve gotta be selling something where people can just check it out, and not have to talk to a person. How can you cash well, how can you always make money?

So I’m like, “Okay, well, we’ll get people to reserve a spot for us to file their taxes for $200.” And then, you know, we’ll finish—you know, just to reserve a spot. So like, during that live, like, six or seven people reserve a spot, so that’s $1,400 just right there.

Yeah.

And then we had like, you know, so that’s where you’re always trying to get your strongest call to action, not in an email, not in a text, not in a video, but straight up and down live. This is why you have QVC, or you have these live—because it’s like, even I have you know, been online and they’re like, “Hey, y’all go buy this book” – “Okay, yeah, I’m gonna buy this book.” So we see a strong call to action, like going live—so the whole purpose is to grow the following, go live, and then you know, trying to get them to become a client. So during that live, I think we also received like 20 leads as well. And so we’re receiving, and it’s just like, well, we’re coming to the point where it’s like, now we have to maybe pull back a little bit, sit down a little bit, get the staffing correct. And then we’re not just hiring anybody at the same time, we got to hire the best. So we’re always like building out that foundation.

It’s very important for me and our team to grow very slowly. We want to control our growth because we’re not—when this first happened last year was just ridiculous, I cannot keep up. What happened in turn was, there was a lack of service—quality of service was terrible. You know, I don’t know why people still gave us those reviews. I mean, but we learned from that. If you grow too fast, you can get greedy, like, “Hey, we gotta shut this thing down.”

Yep.

So income slowed down, we outsourced it to another firm, they didn’t, you know, deliver. So it’s like, “Okay, cool. So this year, it’s like, we got to control our growth—we know what’s going to happen. That’s the exciting thing about it. But we have to extremely control it, because it could ruin our reputation if we go too fast.”

Mmm hmm.

If we’re just worried about the money. It’s not about that. It’s really about just building the relationship and building a business is gonna last.

I think that’s extremely smart. I think some people too often just say, “Hey, it’s business. Let’s bring it in, and then worry about it later.” But yeah, reputation would be huge. When you were doing this one today, was this a 1040 call to action or all business?

It was a freestyle. I was like, okay, you know, I haven’t been like, okay, so I just talked about, you know, a really good thing to talk about this refund shock that’s coming up. Now, like, I love that term—”refund shock.” Because you know how in 2021, we had like five additional COVID credits such as the Child Tax Credit, the Sick and Family Leave Tax Credit, the increase with the Child and Dependent care credit, and all those are just, you know, either going out as completely going away, or completely being reduced. So that’s what kind of what I was talking about. And people are like, “Hey, do you file taxes?” I’m like, “Oh, yeah yeah. I mean, like, you want to reserve your spot? $200.” Boom, I saw them come through. “Okay, cool. Guess what guys, anyone who reserves a spot, I’ll give you a shout out—I’ll say your name. People won’t pay $200 for me to say their name, but we’re also going to fulfill a service. But like, okay, “Hey, Paul, I just got you here. Hey Jessica, y’all want to be like Jessica? Go and fill out the form.”

And so it makes it fun. So I think taxes should also be always be an experience. I don’t believe it should be very transactional. I feel like we want to create the experience. And I tell my team all the time, our competition is not TurboTax, it’s not H&R Block, it’s not the tax firm down the street. Like our tax group starting in 2023, we’re going to be competing, I see it like the four seasons—Equinox, like these luxury brands that are very good at creating the experiences. So I believe we’re just a relationship-based business that creates experiences—we just happen to do taxes. That’s our byproduct on how we create experiences. And so anything that I’m doing, I’m trying to create an experience. “You want to be like, Jessica? you want to…”

Right.

And like, and it just makes it more fun, because tax is always seen as boring. And that’s the whole goal and the vision of the business is to make tax more of an experience, rather than just something transactional.

I love that. You and I, when we were in—where were we?—Vegas, a couple weeks ago.

Partying it up.

Yeah, the Aria. We talked about Ron Baker and his subscription pricing. You were talking about going to see him speak. Did you see him speak?

Yeah, I saw him speak. And so I’m like, “Okay, this dude’s on it.” He’s already like, and I actually yeah, you know, it was like, “Hey, buy his book.” I think I bought it that second. See? Those live events are impressive. In-person has the strongest call to action!

Exactly! I should get a commission.

Yeah yeah, talk to your boy, Ron. Yeah, but so kinda, it’s great, because it’s a thought that I already had, but I did not know how to explain it or convey it.

Yeah.

And it’s great being able—because, you know, this is something I had to communicate to my team, and something that’s always abstract in my brain that I’m not able to communicate. So Ron Baker is an intelligent individual. Anyone who has not heard him, he has this book called Time’s Up that I’m reading right now. And it’s just, I mean, I read it in the gym, like, oh, it’s so good. And I saw him speak. I’m like, “Gosh, like, this is what I’m trying to do!~ This is exactly what I want.”

And so seeing that, he teaches me how to do it and make it better. I had no idea how to do it, how to execute, who else is doing it. And you realize, just like a lot of other people do it. And they’re just like, gosh, she’s like, such a valuable asset to the accounting industry.

Oh, yeah. I’ve had him on the podcast a couple times. And I’m always just in awe hearing him speak and his ideas. And he’s been pushing the envelope on pricing for a long time—value pricing, and now he’s to the subscription pricing.

We’re kind of around pricing right now. Let’s talk a little about that. Because you do on your website show like a three-tier pricing model. Now, is that something you’re going to continue? Or are you going to start going towards the subscription then that Ron talks about

Yeah, so like, this is what I learned from Ron—this is what’s gonna change the game. So we were doing kind of what he talked about, like, we just had our services and we just broke it down monthly or annually. Like okay, this is what it’s typically—it’s gonna cost, divided by 12. This is going to be monthly.

Uh uh. We’re not gonna do that no more. So starting in 2023, it’s like, we’re truly, like creating a membership as if this was like—it’s very—how we think about our packages now, it’s very similar, if you were to go to the gym, and they charge you per equipment that you use, Oh, you want to use the benchpress?

Oh right, yep.

You want to use the dumbbells? Oh, you would like to use the pool, and the sauna and the lockers as well? Nuh uh. Hey, this is what it is. So I work on Equinox, “Hey, you know, you this is a membership, you can use any equipment that you would like.” So that’s the kind of the vision that we’re going to, and that’s what Ron kind of had me wake up on.

So it’s like more of a membership. We wanted monthly, because I love just you know, sometimes you don’t even have to have your, you know, your people on the phone, you see that the money comes through to the bank account. So we’ve already got a couple actually, which has been great, starting in 2023. And we’re going from like a starter package, which is like the very, very basic kind of like the, you know, the hamburger at the McDonald’s, which is 185 a month. And we’re looking at the professional package, which kind of like, probably our most top seller, we’re probably looking at 550 a month. And then we just have this absurd one for those people are like, “Well, I want everything,” starting at $3,000 a month. And that’s just going to provide value. We’re gonna send them monthly baskets, whatever, whatever. I just told my team like, “Hey, what is the craziest thing that you can think of, you know, for a client?”

Right.

You know, “Let’s give them a puppy.”

Hey, but that’s what you do! You just think outside the box. Come up with it.

Yeah. We got some really good things.

And I can’t think of the term he uses now. But he always uses as Walt Disney, and he says “upping the experience,” but he uses a specific term. I don’t know if you’ve heard him say it.

Yeah, maybe I’m not that far on the book yet, I got you though.

He usually talks about it when he’s talking, I’ll have to look it up. Because you would love the term I would think, and I can’t think of it right now. But it’s basically giving them more than they expect type of thing.

Yeah.

And it’s just upping the experience. That’s the thing. Always making, like he talked about, you know, they were gonna do this big parade at the holidays, and his people were telling him, “Well, that’s not gonna—it’s just gonna cost us money, it’s not really going to bring anybody else here.” But it’s going to give them this experience they wouldn’t have expected, we’re going to up that experience for them.

Exactly. That’s the goal.

Yep. Alright. Well, that’s awesome.

And so with this pricing that you’re changing, and everything now, what I think is important, and I think you probably agree, and I think Ron probably agrees too—we’re going to have to tag Ron on this episode, we keep talking about him the whole time—but, is that having a specific niche helps you, one it may just be 1040 info in general, maybe small business, but you have a niche of creators and artist and startup businesses. And so do you feel the same, that building a niche practice or a niche service industry is helpful?

Yes, it’s probably one of the best decisions we’ve made. It’s one of the scariest decisions you make, because you’re still not sure, “Hey, do I cut everybody off?” But we still like, we market ourselves as concentrators, and like, you know, entrepreneurs—but why I can tell you it’s the best decision ever going in this direction? It’s allowed us to become experts, experts in this field, which is like, insane, because we’re learning about like, you know, secret things, like certain apps, that make things better, or certain industry leaders. So we’re becoming not only a resource to them for their accounting and taxes, but like how to save money, or how to make more money, and then kind of connect with others. You just learn so much more.

I remember, sometimes we work with like a couple of dentists we work with, and they ask certain questions, and I’m just like, “I don’t know how to answer it.” You know, if this was a general practice, I mean, of course, we’ll be able to answer it. But if it was like a more of a complex question of where they need advice, and so I felt bad because I lacked in value. I mean, like, there’s certain things like, we have some people who are in construction, like, how do I create a bid? How do I create a commercial bid? I’m not sure. But I know, I can help you on the 1040.

But it’s little things like that, where we lacked the value and I’m like, this is this, you know, this is kind of a disservice. So we’re like, you know, we outsource those type of things. So yeah, niching down has allowed us to do so much better. And I discovered—I’ve always known about niche—but I really discovered the importance of experts. Mainly when I started, I had an eye problem. And I went to like a minute clinic like, “Hey, dude, like, there’s something wrong with my eye,” and he was like, “Oh, snap, you need to go see an eye doctor.” Went to go see an eye doctor, they referred me out to another doctor, then I gotta go see a cornea specialist, then of course, they charge more, but they were able to get, you know, the problem solved. So it’s like, niching it’s so important.

I mean, like another example I can give is like, you know, a parent that has a sick child. Well, you know, you can take them to a doctor, or you can take them to a you know, pediatric, which is a doctor that specializes in children. What if the child has a heart problem as well? Well, you will take them to a pediatric cardiologist, so you get niched down and niche down specifically, because that is a serious need. If a parent’s willing, they’re gonna pay that money to save their kid’s life. And so that’s what we do for our creators and our artists and our entertainers, but we just, instead of saving their life, we’re making their lives easier. We’re creating an experience.

So I believe it’s the most important thing, I believe that it allows you to charge a lot more, because you bring the value, and you have the confidence to charge a lot more. Because you know what you bring to the table.

Yeah! Man, you are all over all my key topics that I love talking about, love hearing people do. Because it was, when I was in practice, I was, you know, before I started Tri-Merit, I was a generalist. And I look back at that time, and I think, “Man, I probably was not helping too many of my clients to the max, because I was trying to do everything.” I was doing the fast food restaurants, and I was doing the construction companies, and I was doing the dental and I was doing the auto, the automotive dealer, and like, I was not an expert on anything.

When I started Tri-Merit—and having this small niche of a tax code I deal with—I just saw that value. And you’ve learned that a lot earlier in life than me, which is awesome. I’m looking forward to watching your firm grow over the next, well, probably after about 10 years, I might not be paying attention to this industry anymore. We’ll see. Um, but for the next 10 years, I’m watching to see what you’re doing.

I got you.

One more thing, I guess, because you had mentioned this too, and technology, and you know, like apps, you said for your clients. How about, like tech stack for you? Are there specific things you’re always trying to automate and get better at or work together? How about running your practice, from a technology standpoint?

Yeah. What’s a great thing about automation is, it can be a very great thing and can be a very deadly thing as well. So what we’ve learned is, before we automate, we have to truly understand the process and the value of the automation. We have to understand the true value of what it means to automate.

So for example, like if we’re sending out email campaigns—like we have a sequence that automatically, you know, it’ll send out a text message, or something like that. But once we’ve done it manually and see the process, that’s why it’s extremely important to us. So things that we’re always trying to automate is client updates. Client updates, they’re always updated, because when I started this firm, people were always like, you know, communication, communication is super important.

Yep.

So like those emails, we’re always like, you know, we’re trying to automate. And when a client signs up, when they even fill out a form, they’re gonna get sent a text message, they’re gonna get sent an update, they’re gonna get sent that, that, that and this that. So I believe automation, it saves us a lot of time. I love it because it saves us time, and it makes that client or member or customer relationship experience a lot better, because it feels like we’re still in communication with them.

Alright. So I think we hit all the key topics, anything that you feel we missed that you want to expand on before we wrap up here.

Um, so if there’s anyone out there listening to this podcast, thinking about getting into content creation, I would say go for it. It’s a great way to market your business. It’s literally free marketing. So the whole purpose in any business’s eyes, they need marketing. I mean, like for any business to grow, they’re also gonna pay for marketing, or word of mouth—referrals are really great thing too. So just let this be your motivation. This is your sign right here, like, boom, I’m hitting you in the head, wake up.

There you go. But that’s kind of like what I want to tell people. Hey, let’s get on this platform, and let’s also help each other out. I can also see sometimes the accounting and tax community can be very toxic. I really, let’s just help each other. You know, we’re all brothers and sisters. We’re all in this together. Let’s all grow together.

Yeah, I noticed that at QuickBooks connect, there was a lot of collaboration, I think, going on there. There was a really good group. I kind of bailed on you guys on the club night after a little while. It’s not really my thing. But that was a good time.

Hey, a couple things before we wrap up. I’m going to ask you for contact information, which I think pretty much is just DukeLovesTaxes everywhere. But you can tell us that. But before that, at the end of each show, you know, we talked about a bunch of business stuff and tax stuff and stuff that we’re all passionate about—you and I are definitely passionate about. But what are your outside of work passions? What do you love doing that is not work related? I know you it sounds like, go to the gym and work out? Is there other things that you have passions for outside of work?

I like playing the piano.

Oh!

I’m self-taught. And then I love growing the relationship with my girlfriend. I love spending time with her. Definitely want a family someday. So I’m always looking to improve our relationship and improve myself. So I would say those are the two things—playing piano and kicking it with her.

Nice, nice.

And then if people want to get ahold of you, is there other places besides DukeLovesTaxes? I’m guessing they can find you there.

Yeah, DukeLoveTaxes. It’s a great one. WorkwithDuke.com. I’m also in the process of coming out with a total, like, full blown education course for EAs and CPAs, and any other tax professionals that want to—either beginning with taxes, learning how to market the practice. It’s called TaxTakeoff.com. That’s coming out in November of 2023.

Wow.

Now pricing at minimum is going to be like five grand, but right now, we’re just had it for preorder for like 997. So check that out. We’ve had a couple preorders in. And I’m like, okay, cool. Like it doesn’t drop until November 2023. But people are already ready. It’s exciting. So it’s like, my whole goal right now is to build a foundation of my business—of this business—then delegate it off. And then we’re going into education for not only, you know, business owners, but other tax professionals, because I believe this industry is kind of like, so let’s break it back up. And so here I am!

Alright. Well, this was one of my favorite interviews I’ve done so far. I love seeing what you’re doing, just starting from the digital marketing to how you’re running your business. And I think everybody can learn a lot. So I really appreciate you being on the show today.

Thanks for having me here, Randy.

Important Links

About the Guest

Duke has been featured on ABC’s Good Morning America, Tax Notes, EA Journal and BloombergTax. He has over three million followers on social media, with 3.4 million on TikTok alone, and growing.

He is an Advanced QuickBooks ProAdvisor, Enrolled Agent, and is one of just over 700 tax professionals who has completed the American Institute for Certified Tax Planners training academy leading to the Certified Tax Coach designation, which he earned in January of 2021. Duke founded Duke Tax in 2018, growing it into the social media sensation it is today through the Covid lockdown.

Meet the Host

Randy Crabtree, CPA

Randy Crabtree, co-founder and partner of Tri-Merit Specialty Tax Professionals, is a widely followed author, lecturer and podcast host for the accounting profession.

Since 2019, he has hosted the “The Unique CPA,” podcast, which ranks among the world’s 5% most popular programs (Source: Listen Score). You can find articles from Randy in Accounting Today’s Voices column, the AICPA Tax Adviser (Tax-saving opportunities for the housing and construction industries) and he is a regular presenter at conferences and virtual training events hosted by CPAmerica, Prime Global, Leading Edge Alliance (LEA), Allinial Global and several state CPA societies. Crabtree also provides continuing professional education to top 100 CPA firms across the country.

Schaumburg, Illinois-based Tri-Merit is a niche professional services firm that specializes in helping CPAs and their clients benefit from R&D tax credits, cost segregation, the energy efficient commercial buildings deduction (179D), the energy efficient home credit (45L) and the employee retention credit (ERC).

Prior to joining Tri-Merit, Crabtree was managing partner of a CPA firm in the greater Chicago area. He has more than 30 years of public accounting and tax consulting experience in a wide variety of industries, and has worked closely with top executives to help them optimize their tax planning strategies.