Help Your Clients Benefit From the Employee Retention Credit (ERC)

The latest data shows that employment is still down roughly 3.6 million jobs despite the efforts that the government has gone through to provide businesses with financial assistance. Your clients may be eligible for the Employee Retention Credit (ERC) to help them keep their team together as we fight to pull through the COVID-19 pandemic.

The ERC provides up to $5,000 per employee during 2020 and up to $7,000 per employee per quarter for the first three quarters during 2021. That’s up to $26,000 per employee for qualifying businesses!

What is the Employee Retention Credit (ERC)?

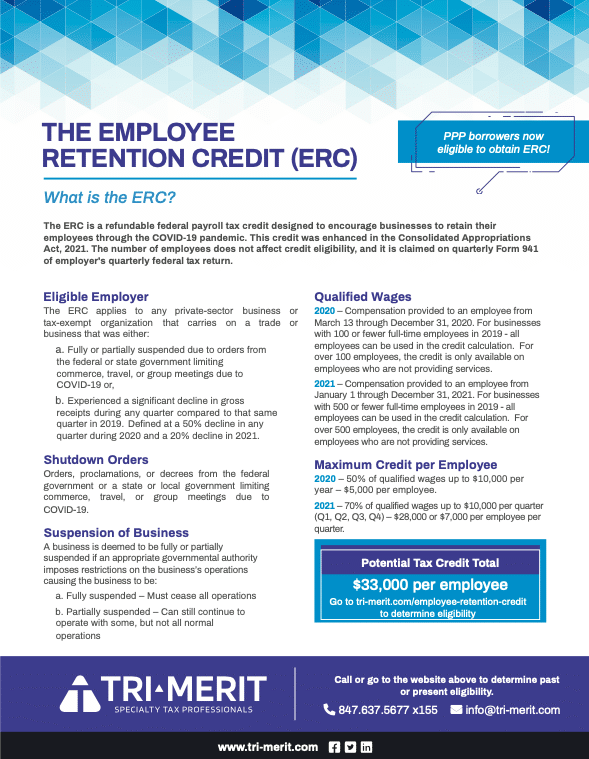

As defined by the IRS, the ERC is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays their employees. It is designed to encourage businesses to retain employees during the Covid-19 pandemic. Also commonly referred to as the ERC Tax Credit, Employee Retention Tax Credit, ERTC 2021, or ERTC, this credit is available through December 31, 2021.

If your client is an eligible employer, then they can get immediate access to the credit by reducing employment tax deposits they are otherwise required to make. In addition, if the employer’s employment tax deposits aren’t sufficient to cover the credit, they can receive an advance payment from the IRS. To capture the credit for prior quarters, an amended 941 must be filed.

Two Ways to Qualify

Any private-sector business or tax-exempt organization that carries on a trade or business and that meets EITHER of the following:

The business had a significant decline in gross receipts during any quarter (2020-2021)

OR

The business was fully or partially suspended due to orders from the federal, state or local government

Great news for the Employee Retention Credit (ERC) and PPP borrowers!

Recipients of the Paycheck Protection Program (PPP) can now potentially qualify for the ERC as well. Thanks to changes that were made as part of the Consolidated Appropriations Act (CAA) and the American Rescue Plan (ARP), recipients of PPP loans may be eligible to obtain the ERC for 2020 and 2021. This is taken into consideration in our ERC qualification form, meaning you may be able to save your clients even more money.

Thought your clients couldn’t qualify for the ERC if they took a PPP loan? Think again.

Fill out our online qualification form to find out if your client’s are eligible to receive the Employee Retention Credit. We’ll send you a follow-up email to schedule a call and review their eligibility!

Changes to the ERC rules in 2021

For 2021, the credit has been extended and is now available on the qualified wages that your client pays their employees after December 31, 2020, through December 31, 2021. In addition, it’s now possible to claim up to 70% of the qualified wages quarterly in 2021 instead of just 50% annually.

The ERC provides up to $5,000 per employee during 2020 and up to $7,000 per employee per quarter forthe first three quarters during 2021. That’s up to $26,000 per employee in tax credits for qualifying businesses! This is a great way to help your clients maximize their tax savings.

Qualifying for ERC

Private-sector businesses and tax-exempt organizations that carry on a trade or business are eligible, but they must also meet either of the following:

- The business had a significant decline in its gross receipts during any quarter of 2020. This is defined as at least 50% of gross receipts for the same calendar quarter in 2019

- When claiming ERC for the period between January 1, 2021, to December 31, 2021, the decline must be at least 20% of the gross receipts for the same calendar quarter in 2019.

OR

- The business was fully or partially suspended due to COVID-19 orders from the federal, state, or local government.

For example, if a business experienced 55% of their gross receipts from the first quarter of 2019, they would not qualify under the “significant decline in gross receipts” test, but they will qualify if there was a government order to suspend their businesses.

In addition, government and state entities and political subdivisions won’t be eligible for the ERC. Self-employed individuals are also not eligible for ERC for their own wages, but it can be claimed if they employ other people. You can check your client’s eligibility with our ERC qualification form. You must enter the client’s details and we’ll send you a follow-up email to schedule a call and review their eligibility.

What Counts as Qualified Wages?

It’s important to note that ERC only takes qualified wages into consideration. There are also certain rules to keep in mind.

For example, if you average more than a hundred full-time employees, only wages for those you retained who are not working can be claimed as they are considered qualified wages. However, if you employ fewer than 100 workers, then you can claim wages for all employees whether or not they were working during the period. This includes certain health care costs that are paid to employees.

For 2021, this threshold has been raised to 500 full-time employees. This means if you have more than 500 employees, you can only claim the ERC for employees who are not working. However, with 500 and fewer employees, you can claim the ERC for every employee.

Amount of Credit for 2020 and 2021

The amount of credit is equal to 50% of up to $10,000 in qualified wages (including any contributions towards health insurance) for each full-time employee for all quarters from March 13, 2020, to December 31, 2020.

For 2021, this credit has been increased to up to 70% of $10,000 in qualified wages (including any contributions towards health insurance) for each full-time employee for all quarters from January 1, 2021, to September 30, 2021.

It’s important to work with your client to ensure that the amount they are claiming is accurate. If you’d like more information on how this is calculated based on regular payroll figures, wages, and Federal Insurance Contributions Act (FICA) taxes, don’t hesitate to get in touch with us today for more information.

ERC Resources

Answers to top questions about the ERC.

Access Our On-Demand Webinars

“Maximizing Credits & Incentives: Employee Retention, R&D and PPP” and “IRS Clarifications and A Technical Update on The ERC”

Does your client’s company qualify for the Employee Retention Credit?

Do your clients qualify for the ERC? Find out.

Contact Tri-Merit today to help maximize your clients’ savings with the ERC

When looking to maximize trust and value for your customers, we understand that you need expert advice on topics such as ERC that may be new or confusing to understand. Tri-Merit is a team of specialty tax experts that can help accountants determine if their clients qualify for ERC, and if they do, we’ll help you maximize their tax savings.

As a trusted advisor to your clients, you’re looking for every way possible to put money back into their bottom line as they recover and rebuild. We’re here to help.

This credit is time-sensitive, so don’t wait. Take a few minutes to fill out our online ERC eligibility form. We’ll review the information as soon as possible then offer a free 30-minute consultation to help you learn more about the ERC in 2021 and if your clients qualify.